How much is auto insurance in Massachusetts? This question lingers in the minds of many residents, as various factors come into play when determining insurance rates. From age to driving record, each element plays a crucial role in shaping the cost of auto insurance. Let’s delve deeper into this complex yet essential topic to gain a better understanding of what influences auto insurance rates in the state of Massachusetts.

Exploring the average costs, minimum requirements, and money-saving tips for auto insurance in Massachusetts will equip you with the necessary knowledge to make informed decisions regarding your coverage. So, let’s embark on this informative journey together.

Factors influencing auto insurance rates in Massachusetts

Auto insurance rates in Massachusetts are influenced by several key factors that determine the cost of coverage. These factors can vary from one individual to another, impacting how much you will pay for your auto insurance premiums.

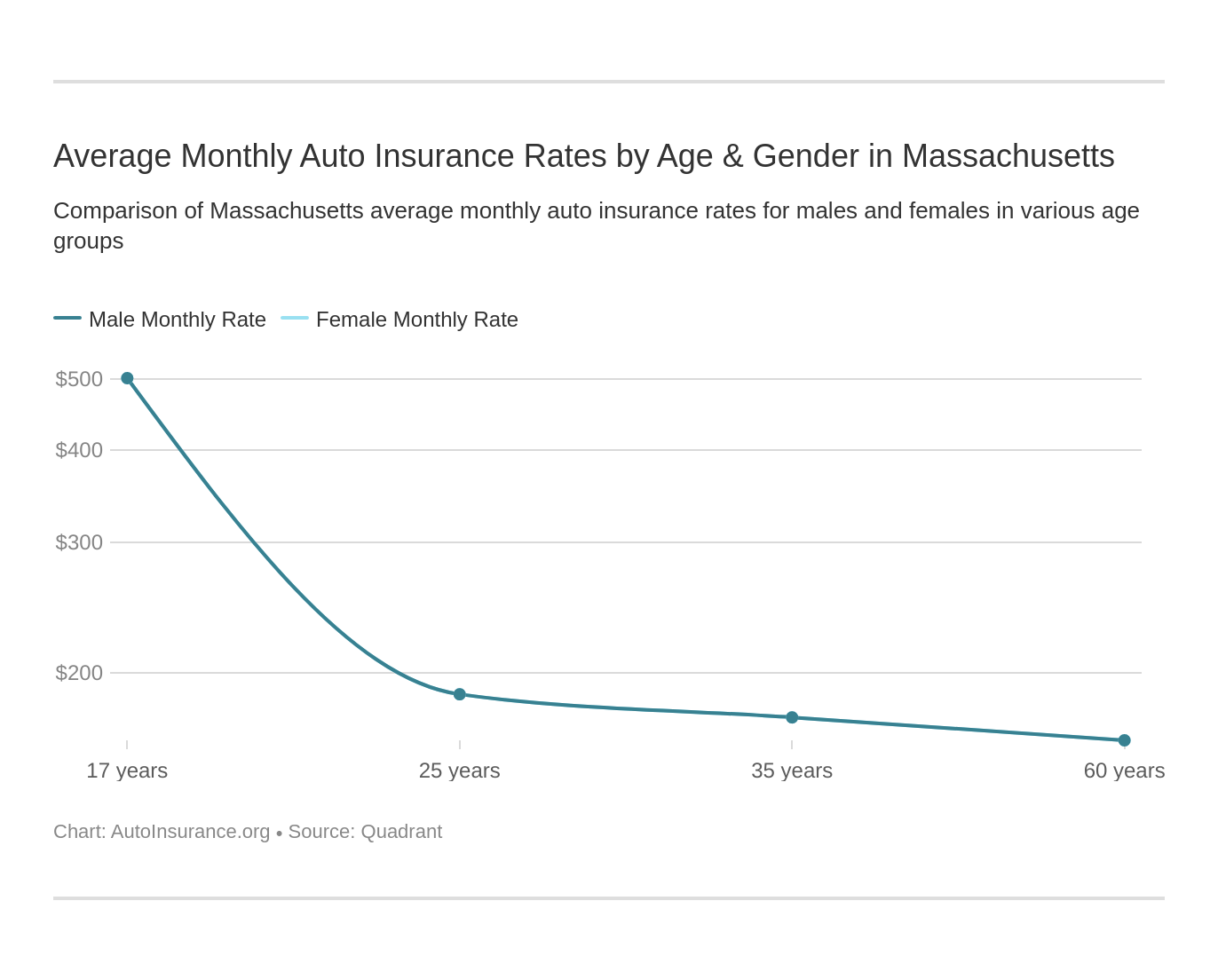

Age, How much is auto insurance in massachusetts

Age is a significant factor that affects auto insurance rates in Massachusetts. Younger drivers, especially those under 25, typically pay higher premiums due to their lack of driving experience and higher likelihood of being involved in accidents.

Driving Record

Your driving record plays a crucial role in determining your auto insurance rates. A clean driving record with no accidents or traffic violations will result in lower premiums, while a history of accidents or tickets can lead to higher insurance costs.

Location

Where you live in Massachusetts can impact your auto insurance rates. Urban areas with higher population densities and increased traffic congestion may have higher rates compared to rural areas with lower accident frequencies.

Credit Score

Your credit score can also influence your auto insurance premiums in Massachusetts. Individuals with higher credit scores generally receive lower rates, as insurance companies view them as lower risk customers.

Type of Vehicle

The type of vehicle you drive can affect your insurance rates as well. Sports cars and luxury vehicles typically have higher premiums due to their higher repair costs and increased likelihood of theft.

Average cost of auto insurance in Massachusetts

As of 2021, the average annual cost of auto insurance in Massachusetts is around $1,200. However, this can vary depending on factors such as age, driving record, and location within the state.

Regional Disparities

The average insurance rates in cities like Boston and Worcester may be higher compared to smaller towns in western Massachusetts. Urban areas tend to have higher rates due to increased traffic and crime rates.

Trends in Pricing

Over the past few years, auto insurance pricing in Massachusetts has been relatively stable, with minor fluctuations based on market trends and regulatory changes.

Minimum auto insurance requirements in Massachusetts

In Massachusetts, drivers are required to carry a minimum amount of auto insurance coverage to legally operate a vehicle on the road. The mandatory coverage includes:

- Bodily Injury Liability

- Property Damage Liability

- Personal Injury Protection (PIP)

- Uninsured/Underinsured Motorist Coverage

Tips for saving money on auto insurance in Massachusetts

To reduce your auto insurance costs in Massachusetts, consider the following tips:

- Compare insurance quotes from multiple companies to find the best rate.

- Take advantage of discounts for safe driving, bundling policies, or being a loyal customer.

- Consider raising your deductible to lower your premiums, but make sure you can afford the out-of-pocket costs in case of an accident.

Final Conclusion: How Much Is Auto Insurance In Massachusetts

As we conclude our discussion on how much is auto insurance in Massachusetts, it becomes evident that navigating the realm of insurance rates involves a careful consideration of various factors. By staying informed about average costs, minimum requirements, and money-saving strategies, you can make sound choices to protect yourself and your vehicle. Remember, knowledge is power when it comes to securing the right auto insurance coverage in Massachusetts.

Popular Questions

What factors influence auto insurance rates in Massachusetts?

The cost of auto insurance in Massachusetts is influenced by factors such as age, driving record, location, credit score, and type of vehicle. Each of these elements can impact insurance rates differently.

What are the average annual costs of auto insurance in Massachusetts?

The average annual cost of auto insurance in Massachusetts varies depending on factors like the city or region. Comparing rates across different areas can help you get a better understanding of the average costs.

What are the minimum auto insurance requirements in Massachusetts?

Massachusetts law mandates specific minimum auto insurance coverage, including liability and personal injury protection. Understanding these requirements is crucial to ensure compliance with the law.

How can I save money on auto insurance in Massachusetts?

To save money on auto insurance in Massachusetts, consider strategies such as comparing rates from different companies, bundling policies, and taking advantage of available discounts. These approaches can help you secure affordable coverage.