Starting with Lafayette TN insurance, this comprehensive guide covers the various aspects of insurance in Lafayette, TN, from types and rates to local providers and money-saving tips. Dive in to discover everything you need to know about insurance in Lafayette, TN.

Types of Insurance in Lafayette, TN

Insurance is an essential aspect of financial planning in Lafayette, TN. Common types of insurance available in the area include health insurance, auto insurance, home insurance, and life insurance. Each type serves a distinct purpose and offers unique coverage benefits. Health insurance provides coverage for medical expenses and treatments, while auto insurance protects against damages and liabilities related to vehicles. Home insurance safeguards your property and belongings from unforeseen events, and life insurance offers financial security for your loved ones in the event of your passing.

Factors Affecting Insurance Rates, Lafayette tn insurance

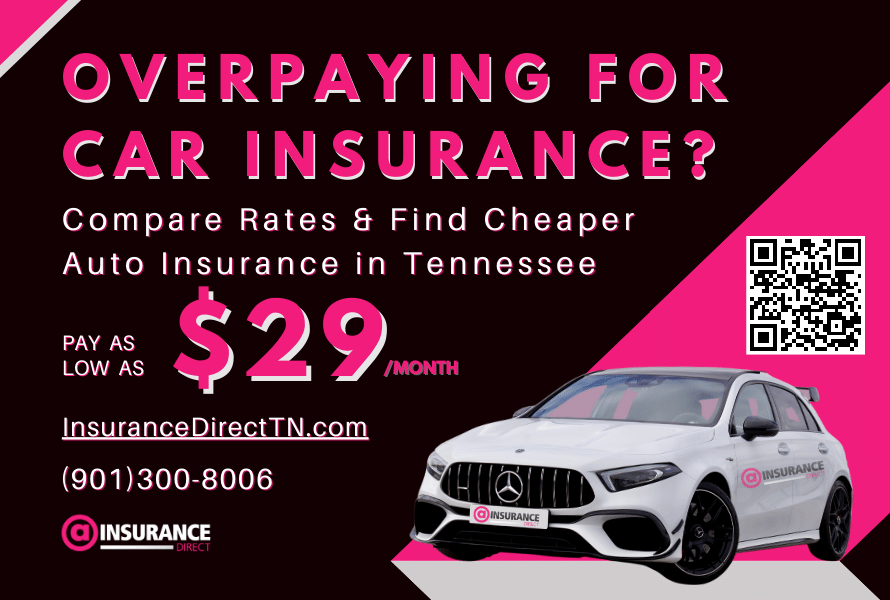

Several factors can influence insurance rates in Lafayette, TN. These include location, age, driving record, and coverage level. Your proximity to high-risk areas, age, driving history, and the extent of coverage you choose can impact the cost of insurance premiums. Additionally, deductibles and coverage limits play a crucial role in determining insurance rates. It’s essential to compare quotes from different insurance providers to find the most competitive rates in the area.

Local Insurance Providers

Lafayette, TN is home to several reputable insurance agencies that cater to the diverse needs of residents. Choosing a local insurance provider offers personalized service, local expertise, and a better understanding of the community’s specific insurance needs. Some of the top insurance agencies in Lafayette, TN include XYZ Insurance Agency, ABC Insurance Services, and LMN Insurance Brokers. Customer reviews and experiences with these local providers highlight their commitment to excellent service and reliable coverage options.

Insurance Requirements in Lafayette, TN

Residents of Lafayette, TN must adhere to mandatory insurance requirements, especially for drivers. Auto insurance is a legal requirement in the state, and drivers must maintain minimum coverage limits to comply with the law. Understanding and meeting these insurance requirements ensures that residents are adequately protected in case of accidents or unforeseen events.

Tips for Saving on Insurance

To save money on insurance premiums in Lafayette, TN, consider bundling multiple insurance policies with the same provider. Bundling options often come with discounts and cost-saving benefits. Additionally, residents can negotiate lower insurance rates by exploring different coverage options, adjusting deductibles, and seeking discounts for good driving habits or multiple policy enrollments. Taking proactive steps to save on insurance can help you secure optimal coverage at affordable rates.

Wrap-Up: Lafayette Tn Insurance

In conclusion, understanding the ins and outs of insurance in Lafayette, TN is key to securing the right coverage for your needs. Whether you’re exploring different types of insurance or looking for ways to save on premiums, this guide has you covered. Take charge of your insurance decisions and ensure you’re well-protected in Lafayette, TN.

FAQ Compilation

What are the mandatory insurance requirements for drivers in Lafayette, TN?

Drivers in Lafayette, TN are required to have liability insurance coverage.

How can residents ensure they meet all insurance requirements in Lafayette, TN?

Residents can ensure they meet all insurance requirements by regularly reviewing their policies and coverage limits.